A Deep-Dive on Retail Media Platform Solutions & Strategies for 2022

When you ask a retailer “what business are you in”, many are likely to respond by saying “selling goods to consumers”.

Chances are high that if that’s their answer today, their answer to the same question in a few years will either be “selling media to brands” or “I’m not in business”.

Over the past 3 years, what was once discussed as an “interesting idea” or “another investment channel for consideration” has attained the status of a “ride or die” pivot.

Retail media advertising can no longer be considered just a “nice to have” component of a retailer’s digital marketing program - it has effectively become the core of the business itself.

In their Q4 earnings reports for 2021, Amazon and Walmart posted $31.1 billion and $2.1 billion in digital ad sales, respectively - numbers which have shaken the retail sector.

Some retailers have been left blindsided - not realizing that their main role in business has shifted from selling products to selling ad space.

Simply put, retailers are now media companies.

There isn’t a way to concisely cover all of the “why” factors (there are many) without taking a deep dive into retail media platforms.

In this guide, we’ll be exploring the modern landscape of retail and eCommerce, how the role of retailers is changing, and strategies for implementing retail media platforms.

Table of Contents

- What is a retail media platform?

- What is a retail media network?

- What factors are driving retail media platform adoption?

- Understanding Amazon’s strategy for success and why it matters

- How retailers are staying competitive

What is a retail media platform?

A retail media platform is a component of a retailer’s website that allows brand marketers and advertisers to buy ad space within that retailer’s digital properties - including their website, app, and in-store digital screens.

The role of retail media platforms is to create a streamlined method for advertisers to purchase and serve advertisements to consumers near points of purchase and decision making - such as digital product listings, search result pages, and checkout confirmations.

Generally, retail media platforms add these functionalities to a retailer’s website:

- A self-serve advertising portal that allows brand advertisers to place their media buys without contacting sales personnel

- A range of different retail media advertising types and formats from which to choose

- A method for campaign managers upload and store ad creatives, as well as manage product details such as description and price

- A campaign reporting module to monitor performance of active media promotions

When a company builds their own solution, it’s often referred to as a “stand-alone” retail media platform, though even in these cases, the retailer often partners with one or more ad tech service providers for development and sometimes advertising demand needs.

Examples of large retailers that have built their own retail media platforms include:

- Amazon (One of the few companies with enough internal resources to be truly “stand-alone”)

- WayFair (Managed to build and deploy their own sponsored listing platform)

- Walmart (Partnered with The Trade Desk)

- Target (Uses their internal media group, Roundel, to manage their solution)

Further reading about each company’s approach to implementing retail media is available here.

What is a retail media network?

A retail media network (commonly abbreviated as “RMN”) is a collection of retailers and/or brand marketers which are connected to the same ad network - allowing them to act as a source of advertising supply or demand for one another.

The difference between a retail media platform and network is largely in the semantics.

Technically speaking, a retail media “platform” is the code component of a retailer’s website that allows brand advertisers to manage media campaigns, while a retail media “network” refers to the components of a media solution that deal with advertising supply and demand.

However, because this is ad tech we’re talking about (a sector riddled with confusing terminology), and because retail media is a newer concept, it’s not surprising that the terms “retail media platform” and “retail media network” are sometimes used interchangeably.

In many cases, the term “third-party retail media network” is used to refer to pre-built “turn-key” media solutions that offer both a platform and a network connectivity component.

Some of the top retail media platform solutions that also offer access to a network include:

- Criteo

- CitrusAd

- PromoteIQ

- Epsilon

- MOLOCO

For retailers that need access to brand traffic quickly, these pre-built solutions are often quite effective at fulfilling the need - but they do so at the expense of pocketing a hefty cut of the retailer’s media revenue for themselves.

Depending on their position in the market and as a company, it’s sometimes more effective for a retailer to partner with an ad tech company to build their own media platform.

The topic of buying a pre-built media platform vs building a proprietary solution is explored in more detail in this resource covering how to implement retail media.

What factors are driving retail media platform adoption?

As mentioned earlier, there are many factors which have ramped up the interest in retail media platforms - some of which you may already be familiar with.

Let’s take a look at some of the primary contributors.

Where consumers are spending their time and money

With just a mention of once popular retail names like Radio Shack, Sears, and Toys R Us (a beloved childhood retailer to many) we’re reminded that retail consumerism has changed.

The popularity of eCommerce has been gaining traction for years, with its convenience gaining favorability amongst consumers for a vast majority of product categories.

It comes as no surprise that the introduction of COVID has accelerated the year over year growth of eCommerce by 32.4%.

Other audiences have experienced similar trends, with formats like digital audio advertising seeing mediums like podcasts increasing in listenership by 42% since the outbreak.

But the virus outbreak isn’t the only factor driving change in consumer behavior.

Traditional television ratings have also been experiencing a steady decline, despite audiences spending more time at home - a trend which has been forcing brand media buyers to reallocate their ad spend to digital alternatives like CTV and OTT.

Even in instances where brick and mortar locations are seeing a gradual return of shoppers, the introduction of digital in-store screens is also forcing retailers to implement innovative media displays to stand out from the competition.

The depreciation of third-party identifiers & programmatic ad fraud

Anyone who works in proximity to digital advertising must be tired of hearing about it by now, but it has to be reiterated that the death of third-party cookies is right around the corner, if Google follows through with their plans for early 2023.

Third-party identifiers power some of the most popular ad targeting techniques, including behavioral, retargeting, frequency capping, and audience extensions - all of which will cease to function when third-party cookies are disabled.

Similarly, Apple has been complying with recent privacy legislations with their latest iOS updates, making it more difficult to effectively target digital ads towards Apple users.

In addition, more advertisers are becoming aware of the risk and general ineffectiveness of programmatic advertising campaigns that are run through general ad exchanges.

This is due in large part to ad fraud.

While an older article by MarTech reaffirms that it was likely an effort on Google’s part to sell people on their own viewability solutions, the numbers didn’t lie in the report that 56% of ads weren’t seen by the people they were served to.

A wide range of more recent articles have since been published by Dr. Augustine Fau, an expert in researching the impact of ad fraud on the industry.

Similarly, despite the available methods for combating ad blockers, a majority of ads served to websites across the web fail to reach ideal audiences in the first place.

All of these factors have lead to retailers and brand advertisers to prefer the use of first-party data strategies like retail media, which are both future-proofed for Google’s cookie update, as well as more reliable and transparent than their third-party counterparts.

Amazon’s success & the competitive retail landscape

The success of Amazon is nothing new, but it’s certainly a contributing factor to the difficulties that retail businesses have been facing in recent years.

As of October 2021, Amazon holds 41% of the eCommerce market share - an increase of close to 3% since 2020.

With more traffic moving online year over year, Amazon stands to further increase their advantage as time goes on - leaving retailers to compete over the remainder of the market.

In addition, retail has always been a tough sector to thrive in, with some of the lowest margin rates amongst verticals.

These already low margins continue to face pressures from factors like competitive pricing and the lingering impacts of COVID - with some estimates forecasting that margins will be as low as 3.2%, down from 6.4% close to a decade ago.

Due to the overwhelming popularity of eCommerce, these trends aren’t expected to reverse in many sectors - leaving many retailers wondering what can be done about the situation.

There’s a lot to be learned from Amazon’s approach to retail, so let’s take a look at that next.

Understanding Amazon’s strategy for success and why it matters

Some refer to retail media as the “third wave” of digital advertising, with search engines being the first and social media being the second.

In a similar sense, if COVID is considered responsible for the “first wave” of brick and mortar closures, Amazon’s retail media strategy might be viewed as the second.

So what’s the secret behind Amazon’s success - and why do they pose a threat to retailers?

Earlier in the article, we saw that Amazon posted $31 billion in ad revenue for 2021 - but that number isn’t the important one.

The important thing to pay attention to from Amazon’s 2021 Q4 earnings report is their overall operating income.

Despite posting a record year in ad sales with a 32% increase over 2020, Amazon’s overall operating income - which is to say, the company’s total profits after expenses, only increased by $2 billion in 2021 over 2020 ($24.9 billion operating income in 2021 vs $22.9 billion in 2020).

Additionally, while Amazon’s eCommerce sales increased by a seemingly impressive 17.5%, Amazon’s eCommerce operating income of $6.3 billion was only about one fifth that of their media program for 2021.

What’s more? Amazon’s retail business would have operated at a loss without its media sales in 2021.

These statistics mean two things.

Firstly, while the exact numbers for Amazon’s advertising program haven’t been released to the public, Amazon’s retail media business has far surpassed AWS as their most profitable offering.

Secondly, based on what we know about Amazon’s operating income numbers, it’s clear that Amazon’s retail business is being heavily subsidized by their ad business.

In other words, Amazon is a retail media company that also sells products.

Amazon’s eCommerce business might very well be on the verge of going under (or at the very least, struggling just like any other retailer) without the support of its retail media program.

In fact, one might even interpret the retail segment of Amazon to be an operational expense for hosting their retail media platform.

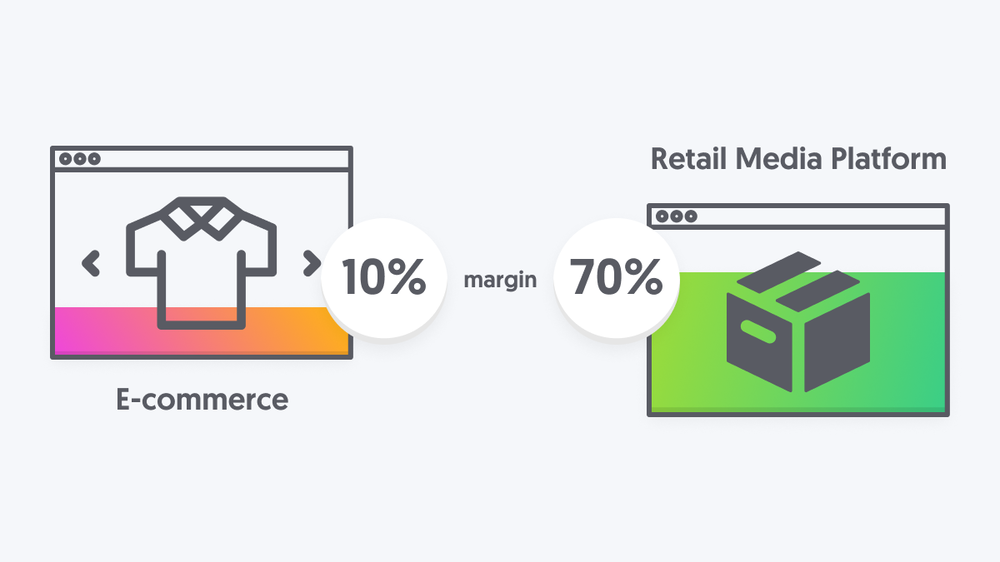

Analysts have speculated that Amazon is raking in somewhere between a 70-75% margin on their ad sales.

The average margin for a modern retail business is about 10%.

Amazon uses their margin advantage to afford predatory price cuts, offer features like same-day shipping, and to continue diverting advertising spend away from other retailers.

Ultimately, these maneuvers are driving retailers out of business - eliminating potential competitors from the retail media sector (where all of the real money is being made).

How retailers are staying competitive

The path to reach consumers has changed - retail media platforms are now the new go-to for most consumers, with Amazon holding 41% of the eCommerce market share as mentioned earlier.

Fortunately for retailers, there’s still a chance to get in on the action as digital storefront popularity continues to see year over year growth.

Here are a few strategies that retailers are implementing to stay competitive:

Place an emphasis on capturing and owning your first-party data

First-party data is the digital gold of the retail media era.

Even if your company isn’t quite sure on how to get started with a retail media platform, at the very least, it should be capturing and storing data about your current customer base.

There’s something that all of these parties have in common:

- Non-endemic brands (brands not directly tied to a retailer’s primary area of focus)

- CTV / OTT advertising platforms (Connected TV / Over-The-Top)

- DSPs (demand-side platforms)

All of these parties rely on data to target their audiences - and they purchase the ability to target their ads using this data at a premium from retailers who have gathered profiles on the behavioral patterns exhibited by their customers.

In other words, it’s very likely that the first-party data held by retailers will become the bridge to some very lucrative partnerships in the near future - with some prominent examples including Walmart partnering with The Trade Desk, as well as Kroger partnering with Roku.

Proprietorship of first-party data is important for a few other reasons as well:

- Owning your own first-party data allows you to place your own monetary valuation on it, rather than having price points dictated by third-parties and the competition of their programmatic marketplaces.

- Truly owning your data, rather than having it stored on a third-party platform or network, ensures that it isn’t used to subtly manipulate bidding activity and/or to give favorable advertising arrangements to competing supply sources.

- According to a report by the Association of National Advertisers, when using retail media as an advertising channel, 33% of brands prefer working with retailers who directly own their sales data.

All of these factors make first-party data an effective revenue stream that retailers can’t afford to miss out on.

Explore omni-channel opportunities

Before diving into the full-scale launch of a retail media platform, consider other elements of your media programs that can help to support your margin growth and compliment your overall strategy.

In a roundtable web conference featuring Rob Rivenburgh, an individual with decades worth of experience in the retail sector, Rob shares one of the biggest things companies get wrong about retail media implementation:

“There’s a tendency towards something I call ‘media-centricity’. A lot of the retail proposition is revolving solely around media, and we’re forgetting the omnichannel aspect of it - including forgetting about things like the brick and mortar and the merchants. I think that’s a mistake, and we need to be more holistic in our approach.”

Rob Rivenburgh, CEO of The Mars Agency

As we previously covered in a more general article about the rise of retail media’s popularity, there are a variety of ways to leverage in-store advertising to increase the effectiveness of brick and mortar locations.

Similarly, in-store data collection allows retailers to increase the value of their media inventory by providing the ability to share unique insights with brand partners.

Other customer touch points can be identified for involvement as well - with things like mobile apps and email programs being a few channels to evaluate and get creative with.

Launch your retail media platform solution with a scalable strategy in mind

As we identified earlier, the margin of the typical retailer is struggling.

While it may seem redundant to point out that increasing profits should be a top priority for retailers, it’s important to note what elements should be avoided in such a pursuit.

An article from 2017 by Harvard Business Review titled “Curing the Addiction to Growth” is highly relevant to the modern retail landscape.

In the article, a broad range of concepts are covered - including managing how many brick and mortar locations are active, improving current stores rather than opening new ones, and generally lowering expenses to increase operational revenue.

In the context of retail media platforms, there are a few things retailers can keep in mind to maximize their margin gains:

- The more the platform is automated, the more margin advantage it will offer. Look for features like self-serve advertising and automated content tagging to support contextual advertising in your retail media solution.

- Retailers should consider partnering with an ad tech infrastructure partner, rather than a third-party network, if their business already has an audience at scale. Doing so allows retailers to take advantage of SaaS pricing instead of revenue sharing models which can cut deeply into margin potential.

Invest in customer experience

If the retail aspect of your business is going to remain relevant, you’ve got to compete against Amazon’s customer experience offering, which is no easy task - but also not impossible.

Creating a customer-oriented growth strategy is easier said than done, and it’s part of why Amazon has become so successful.

The customer has been at the core of Amazon’s business model since day one - and the offered convenience is what consumers crave.

One of the best illustrations of how customer-oriented growth works is featured in what HubSpot refers to as “The Flywheel” - which serves as a framework to convert a standard customer funnel into a self-perpetuating loyalty engine.

(HubSpot's "Flywheel of Success" model for customer acquisition.)

If possible, try taking a page out of Amazon’s book - take some loss in retail profitability in order to bolster your customer experience. The happier your customers are, the more data you can collect, and the more your audience will be worth to your brand partners.

For example, while it may generate overhead, a retailer who hires staff that are experts in a given sector to interact with customers and/or create informative content surrounding a product niche adds a value proposition for people to frequent that retailer over competitors.

Another great source for further reading on the topic of profitability vs customer experience is available in an article titled “The Retail Profitability Paradox” by MIT Sloan Management Review.

Position your business as a unique media partner that brands can trust

Brands are channeling more money than ever before into Amazon’s media monopoly.

In order to pull advertisers away from the Amazon vortex, retailers need to be able to provide an enticing reason to do so.

This can be difficult to accomplish, as the retailer-brand relationship has traditionally been one in which retailers buy products from brands.

In the current landscape, things have changed - retailers are becoming service providers that rely on brands to buy from them instead.

But brands aren’t simply going to redirect their media funds because they feel bad for retailers - they need a tangible value proposition.

This is especially true in instances where programs like co-op advertising have taken place within partnerships, as the introduction of retail media into the mix can often feel very much like a new form of “sales tax” to brands.

A few things retailers can keep in mind to establish successful media relationships include:

- Highlight the unique value of your particular audience - for example, its scale, or its contextual alignment with brand partners where applicable.

- Demonstrate the value and granularity of your first-party data.

- Explain the current retail landscape to brand partners. Showcase the benefits of retail media advertising to justify the proposal.

- Review the advantages of direct media sales vs programmatic advertising, particularly in the absence of third-party identifiers in the future, and in relation to programmatic ad fraud.

- Consider building marketing programs that cater to non-endemic brands to attract a diversified network of advertising partners.

- Partner with ad tech companies that can help you to easily navigate the ad campaign reporting and optimisation process. The average brand sells through 5-6 retail media platforms. Offering a “hands free” management experience is highly appealing.

Implementing a retail media platform solution in your business

There are an overwhelming number of factors to consider when piecing together a strategy to handle the deployment of a retail media platform.

In reality, while this article has touched on many of the most popular topics, the space is still in the process of evolving, and it’s a situation that affects every retailer differently.

While the clock is certainly ticking with Amazon’s recent advances, Rome wasn’t built in a day, and due to the modular nature of most retail media strategies, many experts recommend taking an incremental and phased approach to implementation.

During the sourcing process for tools and systems that solve for your particular challenges as a retailer, we encourage you to explore AdButler - an ad serving solution that offers everything a retailer could ask for in their retail media platform:

- A well-documented and easy-to-use ad serving API

- Complete support for every ad format (display, video, audio, native, sponsored listings, etc.)

- A self-serve marketplace portal for automating direct deals with advertising partners

- A supply-side programmatic solution that guarantees complete data privacy and control

- First-party data contextualization to increase ad relevance across entire web properties

- An email ad server for monetizing consumer mailing lists

- Custom development for any extras you or your advertising partners may need

- Custom reports that make optimizations easy to identify and performance simple to share with brand partners

The AdButler team has over two decades of experience in providing and configuring ad serving solutions for both publishers and advertisers.

We’d love to share a conversation with you. Ask us a question today!