What Is a Travel Media Network? Why Travel Brands Are Becoming Media Owners

For the past few years, Retail Media Networks have dominated the conversation. Brands realized retailers weren’t just sellers, they were media owners sitting on goldmines of first-party data and purchase intent.

Now we’re seeing the same structural shift happen in travel.

Airlines. Hotel groups. OTAs. Loyalty programs. Tourism platforms.

They’re all arriving at the same realization:

We already own the decision moments advertisers value most—we just haven’t operationalized them as media.

This is where Travel Media Networks come in.

Advertising Is Moving From Rented to Owned Media

For years, advertisers relied on rented attention:

Third-party platforms

Broad targeting

Optimized for reach, not relevance

That model is breaking down.

Signal loss is real. Performance is harder to sustain. And advertisers are increasingly skeptical of environments where they don’t control data, distribution, or context.

What they want now:

First-party data

Direct audience access

Clear intent signals

Brand-safe, context-rich environments

Travel companies already check every one of those boxes.

Intent Matters More Than Reach (And Travel Has It in Spades)

Reach tells you how many people saw an ad.

Intent tells you how ready someone is to act.

That’s why intent-based advertising consistently outperforms broad awareness campaigns, especially in tighter budget cycles.

Travel is uniquely powerful here because intent isn’t a single moment. It unfolds over time.

A typical travel journey includes:

Inspiration

Research

Booking

Pre-trip planning

In-journey moments

Post-trip follow-ups

At every stage, travelers are making decisions.

And travel companies don’t just observe those decisions, they sit inside them.

Travel companies sit inside journeys, not just impressions.

That’s the fundamental difference.

Why Travel Was Always Going to Become a Media Network

1. First-Party Data Is Built Into the Business Model

Travel platforms don’t guess who their customers are.

They know:

Where people are going

When they’re traveling

How often they travel

Who they travel with

What they spend on

This data exists because it has to; bookings, loyalty programs, check-ins, itineraries.

That makes travel data both accurate and actionable.

2. Context and Timing Drive Performance

Seeing an ad for luggage after you get home is fine.

Seeing it while you’re booking a long-haul flight? That’s relevance.

Travel environments naturally provide context:

Airports

Apps

In-flight screens

Booking flows

Confirmation emails

Destination content

Advertising here doesn’t interrupt the experience, it complements it.

When monetizing travel audiences is done correctly, relevance increases while friction decreases.

3. The Technology Finally Exists

This change wasn’t possible at scale five years ago.

Now, modern travel advertising infrastructure can:

Activate first-party data responsibly

Control frequency and relevance

Support web, mobile, email, DOOH, and in-journey formats

Measure performance beyond clicks

When first-party data becomes mandatory, when advertisers prioritize intent over reach, and when technology can activate owned audiences at scale, media models change.

Travel sits at the intersection of all three.

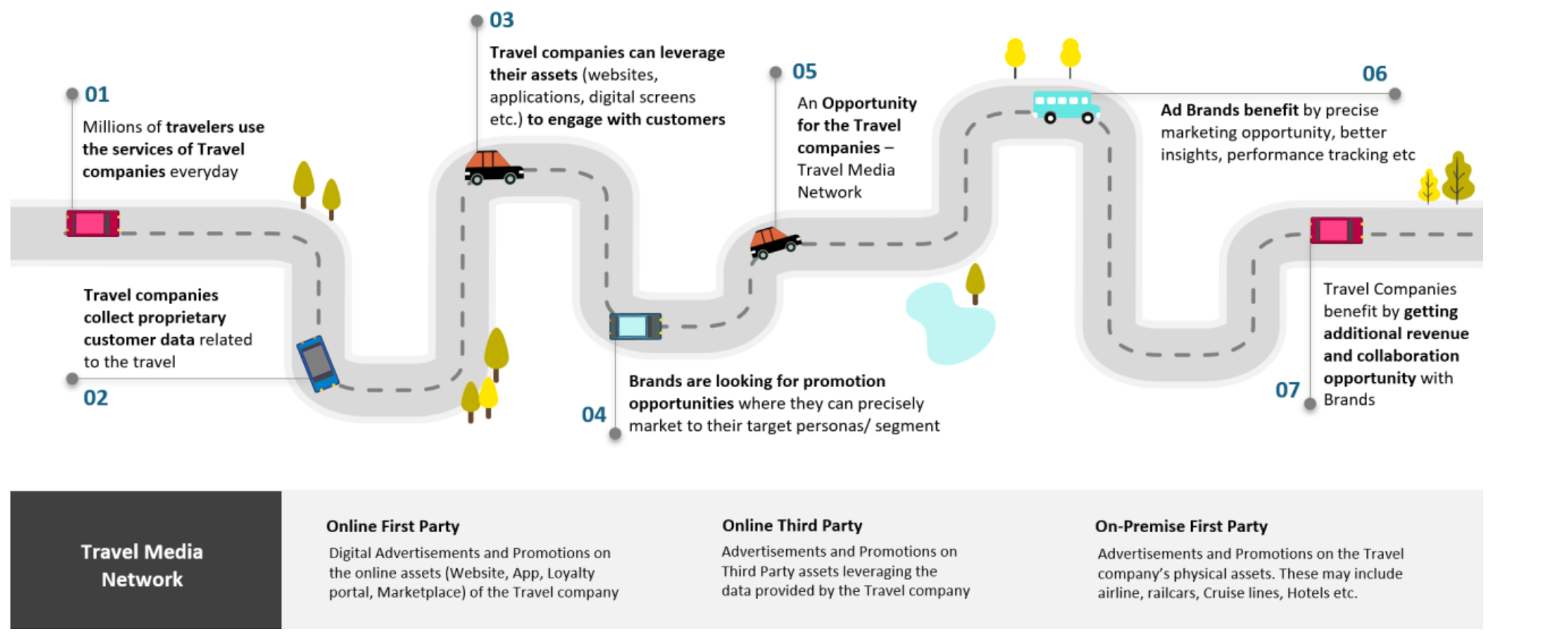

So, What Is a Travel Media Network?

From our perspective:

A Travel Media Network is an owned media environment where travel companies use first-party data and direct touchpoints to deliver relevant advertising inside high-intent moments across the travel journey.

This is not about adding more ads.

It’s about monetizing travel audiences responsibly.

That distinction matters.

Key Characteristics of a Travel Media Network

A true Travel Media Network includes:

First-party audience segmentation

Owned digital and physical inventory

Centralized ad serving

Direct advertiser relationships

Closed-loop measurement

Governance over customer experience

Without these elements, it’s not a media network.

It’s just inventory.

Want a deeper breakdown of how to structure a Travel Media Network? We’ve documented the operational, technical, and governance components required to launch and scale one responsibly.

Download the Travel Media Network Playbook →

What a Travel Media Network Is Not

Before talking about what makes these networks successful, it’s worth clarifying what they are not.

A Travel Media Network is not:

Open exchange inventory

Remnant ad placements

Programmatic clutter layered onto core experiences

Monetization at the expense of traveler trust

When executed poorly, the media becomes noise.

When executed correctly, it becomes infrastructure.

This Isn’t Experimental. It’s Structural.

Some shifts happen because of hype.

This one is happening because the fundamentals changed.

Travel Media Networks exist because:

First-party data is now essential

Advertisers care more about decision moments than impressions

Travel companies already own the customer relationship

Modern ad tech can support advertising inside core experiences

Once those conditions exist, the outcome is inevitable.

The only real question is who builds it well.

Where Most Travel Media Strategies Break Down

Here’s the mistake we see repeatedly.

Companies rush to:

Add ad placements

Launch sponsorships

Sell inventory before defining the experience

Without:

A clear data strategy

Control over delivery and measurement

A long-term view of the ecosystem

That’s how media networks stall.

The strongest Travel Media Networks start with infrastructure—not inventory.

The Role of Ad Serving in a Travel Media Network

A Travel Media Network is a system. At the center of that system is ad serving.

An ad server allows travel companies to:

Control how and where ads appear

Manage multiple advertisers and campaigns

Activate first-party data for targeting

Ensure brand safety and relevance

Measure performance across touchpoints

Maintain governance across owned inventory

Without centralized ad serving, monetization becomes fragmented quickly.

This is where independent ad serving platforms like AdButler fit—not as a bolt-on monetization layer, but as core infrastructure that gives travel brands control over inventory, data activation, measurement, and advertiser relationships.

Travel Media Networks aren’t just about selling placements—they’re about building durable systems for monetizing travel audiences with control and transparency.

That requires owned infrastructure.

Why Travel Media Networks Are Becoming Core Infrastructure

Travel Media Networks are moving from experimental initiatives to core commercial infrastructure.

As advertiser demand increases and travel brands look for sustainable revenue diversification, monetizing owned attention is becoming part of the operating model.

Travel brands already control demand, identity, and context. What’s changing is the expectation that this demand should be operationalized with the same rigor as any other revenue function.

Organizations that approach media as infrastructure—not a campaign—will build durable, scalable programs that advertisers trust.

How Advertisers Win Inside Travel Media Networks

From an advertiser’s perspective, Travel Media Networks solve real problems:

Access to high-intent audiences

Contextual relevance

Reliable first-party data

Measurable performance

Multi-stage journey engagement

More importantly, they unlock timing.

Not just who to reach, but when to reach them.

That’s what drives outcomes.

The Future of Travel Advertising Is Owned Infrastructure

The same shift that turned retailers into media owners is now unfolding in travel.

The difference is that travel intent is richer, longer-lived, and deeply tied to real-world journeys.

This category is being shaped right now — by the companies building systems, not just selling placements.

At AdButler, we work with organizations that want to own their media stack, activate first-party data responsibly, and scale travel media monetization without handing data, margin, and control to external platforms.

If you’re exploring how a Travel Media Network fits into your business, or pressure-testing what it would actually take to build one properly, start with infrastructure.

Because in this category, control compounds.

Ready to operationalize your Travel Media Network? The Travel Media Network Playbook walks through infrastructure, ad serving, governance, and monetization frameworks used by leading travel brands.

Download the Travel Media Network Playbook →

Travel Media Network FAQs

Are Travel Media Networks the Same as Retail Media Networks?

They’re related but structurally different.

Retail Media Networks are built around point-of-purchase behavior. Travel Media Networks are built around journeys.

Travel intent unfolds over days, weeks, or months, creating multiple high-intent decision moments before, during, and after a transaction.

Retail captures intent at checkout. Travel captures intent across the entire journey.

That extended window makes Travel Media Networks uniquely powerful for monetizing travel audiences with first-party data.

Who Should Be Building a Travel Media Network?

Any travel company that owns:

First-party customer data

Direct digital or physical touchpoints

Moments where travelers are actively deciding

This includes airlines, hotel groups, OTAs, loyalty programs, destination platforms, rail operators, cruise lines, and airport operators.

The key isn’t scale—its proximity to intent and control over first-party data in travel.

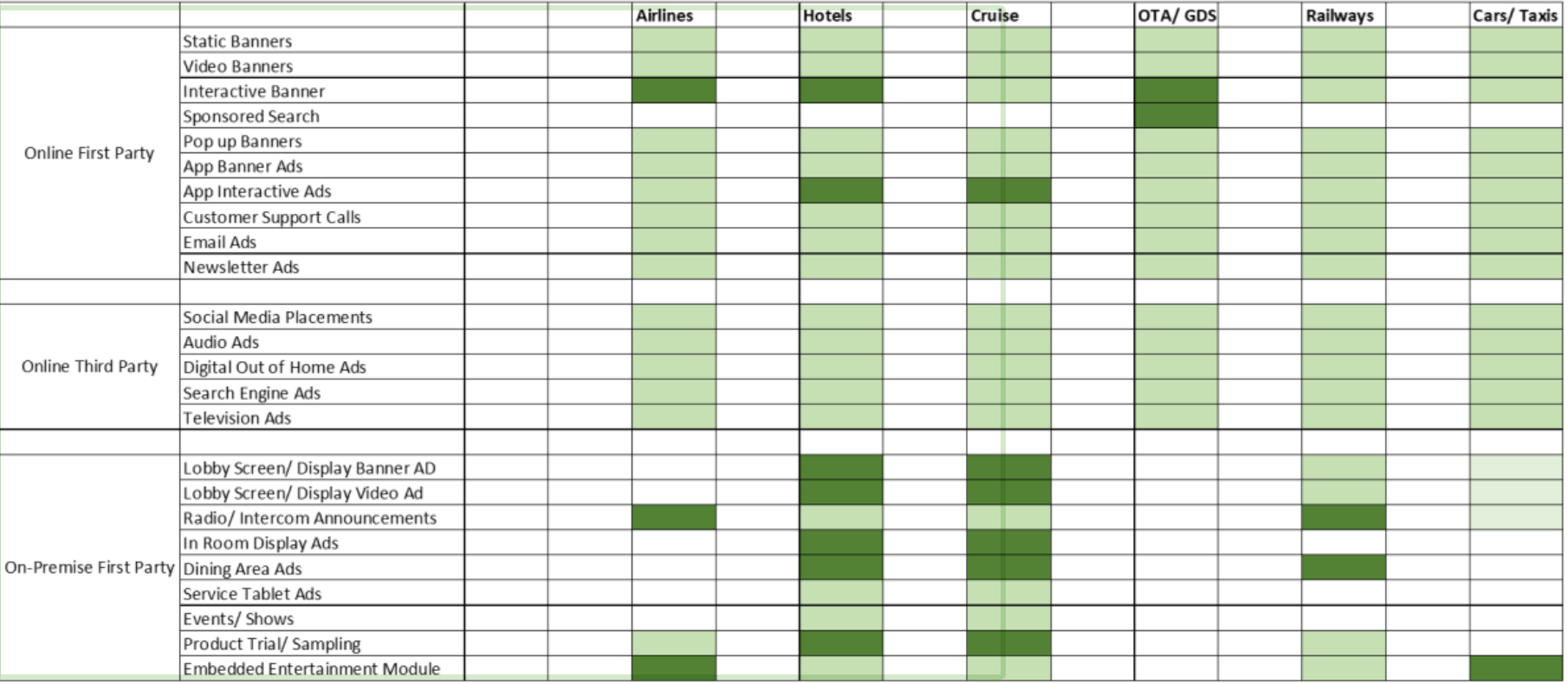

What Types of Advertising Work Best in Travel Media Networks?

Advertising formats that align with traveler intent perform best, including:

Sponsored placements within booking flows

Contextual display during trip planning

In-journey experiences (in-app, in-flight, on-property)

Post-booking recommendations

The principle is relevance.

Travel Media Networks succeed when advertising supports decisions travelers are already making—not when it disrupts the experience.

How Do Travel Media Networks Protect the Customer Experience?

Strong Travel Media Networks are built with infrastructure and guardrails, including:

Controlled frequency management

Clear relevance standards

Separation between monetization and UX design

Data governance policies

When supported by centralized ad serving and clear governance, travel advertising becomes additive—not intrusive.

Do Travel Media Networks Require Massive Scale to Succeed?

No.

Scale helps, but infrastructure and intent matter more.

Even regional airlines, boutique hotel groups, or destination platforms can build effective Travel Media Networks if they control first-party data and high-intent environments.

Successful travel media monetization depends on ownership—not just audience size.

How Is Measurement Different in Travel Media Networks?

Measurement goes beyond clicks and impressions.

Travel Media Networks can tie ad exposure to real business outcomes, including:

Bookings

Upgrades

Ancillary purchases

Loyalty engagement

Repeat travel

Because travel companies control identity and transaction data, they can provide advertisers with clearer attribution and performance visibility.

When Should a Travel Company Start Building a Media Network?

Before advertiser demand peaks.

Travel companies that invest early in infrastructure, governance, and ad serving are better positioned to scale responsibly as Travel Media Networks mature.

Waiting until competitors define the category often means losing control of monetization strategy.